Using Behavioural Insights to Strengthen Enforcement

ETHOS Issue 17 June 2017

Introduction

Governments are vested with the authority to enforce rules and regulations for the orderly functioning of society. They have an interest to ensure that as many people comply with regulations as possible, because this helps to reduce administrative costs significantly, while contributing to desired public outcomes.

In cases of non-compliance, there already are punitive consequences in place, based on the severity of the offence. No citizen would like to receive a warning letter, or be given a penalty. At the same time, there are those who fail to comply with the rules, despite well-designed schemes and appropriate penalties. Understanding why people are not acting and responding in a timely manner is a start to enforcing rules more effectively.

In Singapore, research from several government agencies shows that incorporating behavioural insights (BI) to make simple changes in the way they communicate with the public can nudge behaviours and result in sizeable improvements in compliance rates. As aptly put by Jason Furman, Chief Economic Advisor to former US president Obama, “(e)specially well-chosen behavioural policy interventions can have nano-sized costs and produce extremely high benefit-to-cost ratios”.1The experience from a number of public agencies in Singapore in using BI to encourage on-time settlements, and to nudge overdue customers to take action immediately, bears testimony to the veracity of Furman’s observation.

Understanding why people are not acting and responding in a timely manner is a start to enforcing rules more effectively.

Encouraging On-Time Settlements

Applying BI, the Inland Revenue Authority of Singapore (IRAS) sought to help two different customer groups — newly incorporated companies and property owners — file their returns (see “Increasing Tax Filing Compliance of Newly Incorporated Companies”) and pay their taxes on time (see “Encouraging Property Owners to Pay On Time”) respectively. Common features of these interventions included customised reminders and letters, and the use of loss aversion by emphasising the need to take prompt action in order to avoid late penalties. The Land Transport Authority (LTA) has also applied BI to nudge vehicle owners to pay their road taxes on time (see “Understanding How Nudges Interact”).

Increasing Tax Filing Compliance of Newly Incorporated Companies

The Problem

Each year, companies receive letters from the Inland Revenue Authority of Singapore (IRAS) reminding them to file their corporate tax returns on time. These letters provide information tailored to the needs of various company segments. While the vast majority of companies file on time, IRAS has found that one particular profile of newly incorporated companies (NICs) was more likely to be late in filing their returns, compared to other firms.

The Trial

In its re-design of the reminder letters, IRAS incorporated a number of BI-based approaches, including (a) a “to-do” checklist of important actions to help NICs quickly take the necessary steps for tax filing, and (b) highlighting assistance channels, such as free seminars or tax guides, for NICs needing additional help with tax rules and requirements.

Besides these features, IRAS was interested to know whether a loss aversion frame, by highlighting the punitive consequences for failing to file on time, would lead to improved compliance. This idea was motivated by data suggesting that NICs tend to be less aware of tax matters, with some not even aware of the penalties for non-compliance. Accordingly, an alternative version of the redesigned letter was trialled, highlighting the consequences of failing to file on-time:

“If you do not file on time: Failure to file returns is an offence under the Income Tax Act. You may be subject to fines, penalties and court summons. To avoid these enforcement actions, please file your company’s income tax return on time.”

The Results

A two-arm randomised controlled trial (RCT) showed that the letter highlighting punitive consequences led to 55.5% of NICs filing their returns on time, 6.5 percentage points more than the group of NICs receiving the letter that did not employ the loss aversion frame. From this study, IRAS has concluded that customising communications and highlighting negative consequences for non-compliance could help NICs avoid downstream problems such as late filing penalties.

Encouraging Property Owners to Pay on Time

The Problem

IRAS wanted to encourage people with overdue property taxes to pay their taxes immediately. Their proposed solution involved sending trial text messages to encourage immediate action on property tax.

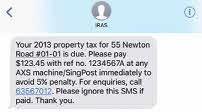

Figure 1: Trial Text Message to Encourage Immediate Action on Property Tax

The Trial

IRAS ran a two-arm RCT comparing a control group (which did not receive any text message) with a treatment group (which received a BI text message). The BI-informed text messages were designed to prompt recipients to take immediate action, by recommending the most convenient payment mode and highlighting that taxpayers still had a “last chance” to avoid losses before penalties are imposed.

The Results

The text message trial was overwhelmingly successful, with 47% of text message recipients promptly paying their overdue tax compared to 16% in the control group. The text reminders have also brought about other benefits to taxpayers and IRAS. Calls and walk-ins dropped from 10% to 4% as fewer taxpayers called in for assistance and clarification; 81% of taxpayers surveyed also said that they liked having the text reminder. With this encouraging outcome, IRAS has scaled up the use of text reminders. Today, property owners receive text reminders from IRAS before the gazetted payment due date of 31 January.

Understanding How Nudges Interact

The Problem

The Land Transport Authority (LTA) regulates close to one million vehicles in Singapore, including matters related to road tax. LTA’s standard practice is to send a renewal notice to vehicle owners one month prior to road tax expiry. However, historical data showed that about 10% of all vehicle owners still end up making late renewals.

The Trial

LTA sought to evaluate the effectiveness of behavioural interventions in improving on-time renewals. By redesigning both the renewal notice and its accompanying envelope, LTA could test the individual and combined effects of nudges in both collaterals, gaining greater insight into how the nudges interact.

Redesign of Envelopes

The front of the envelopes accompanying renewal notices was redesigned to enhance the saliency of settling road tax on time, by adding a prominent and explicit call to action that reads “Renew Your Road Tax online in 3 minutes”. A social norm statement was added to the back of the envelopes, citing the high proportion of vehicle owners who renew their road tax on time (Figure 2).

Figure 2. Back of Accompanying Envelopes – Previous and Redesigned Versions

Redesign of Renewal Notice

The renewal notice itself was also redesigned to include a simplified message, stating renewal and expiry deadlines. LTA also tested the effects of two messages:

- Loss aversion statement: “Be On Time! Avoid Late Renewal Fees”

- Social norms statement: “Be On Time! 9 out of 10 in Singapore Renew Their Road Tax on Time”

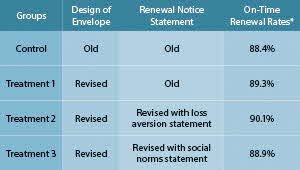

To test the effects of both the redesigned envelope and letters, the randomised controlled trial consisted of three treatment groups (Table 1).

Table 1. RCT Design – Treatment groups and control group

\* All treatment effects were statistically significant at the 5% level (as compared to the control group). Newly registered vehicles were excluded from this analysis.

The Results

Treatment Group 2 (revised envelope and redesigned renewal notice with loss aversion statement) was the most effective at encouraging on-time road tax renewals. It achieved the highest on-time renewal rate of 90.1%, or 1.7 percentage points more than the control group. An interesting aspect of this trial was the ability to examine the individual effects of the nudges and how they interacted when combined. It appears that layering the loss aversion message framing in the renewal notice with the social norms message at the back of the envelope is more effective than highlighting the social norms message alone (Treatments Groups 1 and 3).

The behavioural effects of the interventions were also found to vary across the different segments of the vehicle owners who were involved in this trial. For example, businesses/corporate vehicle owners did not respond in any significant way to Treatment 1 (envelope redesign only) compared to individual vehicle owners. The most effective nudge for them also came through the loss aversion message (Treatment 2). This may be because businesses tend to be more sensitive to profits and losses.

Following the conclusion of this study, LTA is now using the redesigned envelope and the loss aversion statement in its communications with motorists on road tax related matters.

Nudging Overdue Customers

Most enforcement agencies rely on a reminder system to prompt people to pay their fines early. However, there will always be cases that end up being escalated to the courts. As this is a time consuming process, agencies are testing ways to achieve early settlement. One proven way of nudging people in this direction is to convey the consequences more saliently — by highlighting the penalties of late or non-payment and the action they can take to avoid higher fines and court action (see “Increasing Compliance to Payment of Parking Fines” and “Nudging Vehicle Owners in Arrears to Settle Immediately”).

Increasing Compliance to Payment of Parking Fines

The problem

Motorists who are late in making payment receive reminder letters to settle their parking offences, failing which, court action would be taken. The Urban Redevelopment Authority (URA) wanted to test if more clearly worded and better designed letters could encourage motorists to take action promptly and reduce the number of late payers downstream.

The Trial

URA ran an RCT comparing a new set of reminder letters to existing ones. The new letters were designed to nudge motorists to take action promptly. For example, important information was printed prominently in colour and bold print, in the title and in a call-out box.

In particular, the first reminder letter was redesigned to highlight a social norm — that the majority of motorists pay their fines promptly. It also pointed out the consequence of non-payment — that the motorist may face higher penalties and court action.

The Results

The redesigned first reminder letter increased the percentage of motorists who paid up within the deadline. Of those who received the redesigned letter, 69% paid within the deadline, compared with 65% of motorists who received the previous version of the letter. The new letters helped more motorists avoid higher fines and court action.

Given the positive trial results, URA has switched to using the revised reminder letters starting from April 2017.

Nudging Vehicle Owners in Arreas To Settle Immediately

Each year, around 7,200 vehicle owners end up in road tax arrears of more than three months. In such cases, a Notice to Attend Court is issued stating that a court charge is imminent. Accompanying the court notice is an Advisory Note providing information on how the case might be settled out of court.

To reduce the number of offenders ending up in court, LTA conducted an experiment to test if a refreshed Advisory Note could increase the propensity for road tax arrears to be settled immediately.

The Trial

Based on existing evidence, LTA was confident that a nudge to trigger loss aversion could be implemented in the redesigned Advisory Note without further testing. To these vehicle owners in arrears, LTA inserted a prominent call-to-action stating that a court charge (and by implication, further losses through higher fines) could be easily avoided by immediate payment of outstanding road tax.

However, there was scope to apply more behavioural insights in the redesigned Advisory Note, and so, an RCT was designed to test the efficacy of three other nudges:

- Specific cut-off dates: E.g. “If you do not pay by DDMMYY” as opposed to a generic cut-off date presented as “If you do not pay by 14 days to Court Date”;

- Social norms: E.g. “9 in 10 pay their road tax on time”; and

- Using a red background as an additional visual warning of the seriousness of the situation.

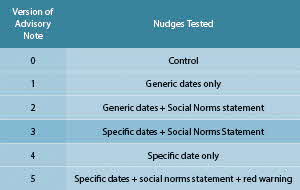

The RCT was conducted with 1,774 vehicle owners. A control version (old Advisory Note) and five treatment versions of a revised Advisory Note were tested (see Table 2).

Table 2. Control and Treatment Versions of the Advisory Note

The Results

The results showed some success in achieving desired outcomes. Those who received the Advisory Note with specific dates and a social norms statement were 6 percentage points more likely to settle their arrears promptly compared to the control group.

LTA has now implemented the redesigned Advisory Note, and results have been encouraging. The proportion of owners who settled 14 or more days before their court date has increased from 30% to 48%. Moreover, arrears of 2.5 to 6 months duration have also been reduced by about 30%.

Learning Points

These examples of successful behavioural nudges in strengthening enforcement suggest common factors relevant to Singapore’s public sector context:

Conclusion

Our agencies are making good progress in using BI to achieve their regulatory objectives, but more work lies ahead. For instance, LTA is looking into the efficacy of measures such as minority norms (e.g. “You are among the last 5% of vehicle owners who have yet to pay their tax”) in encouraging immediate compliance to road tax matters. URA is studying ways to simplify letters when inviting business owners to renew their expiring planning permission. IRAS is considering how BI can be applied to improve service delivery and to enhance tax reporting accuracy.

There continues to be a common imperative for all our enforcement agencies to adopt more learning, innovating and trials, in designing more effective communications, and finding out what works better for both the agency and its customers.

NOTES

- J. Furman, “Applying behavioral sciences in the service of four major economic problems,” Behavioral Science & Policy, 2(2016): 1–7.