Aid for Work: The Singapore and US Models in Context

ETHOS Issue 03, Apr 2010

The past year has seen the implementation of Workfare in Singapore. Battered by globalisation and rapid economic restructuring over the last decade, lower-income groups in Singapore have seen their real wages stagnate and even decline. Recognising that this group requires more help to remain engaged in work, the Singapore Government embarked on its Workfare strategy, where aid is provided on the condition of work.

The idea of having individuals work in exchange for the aid they receive is not unique to Singapore. In developing its own responses to the phenomenon of low-wage stagnation, Singapore’s policy - makers looked to welfare reform in other parts of the world. The creation of the Workfare initiative in Singapore was to some extent inspired by the US Bill of welfare reforms designed to encourage economic self-sufficiency.

WORKFARE IN THE US AND SINGAPORE: VIVE LA DIFFÉRENCE?

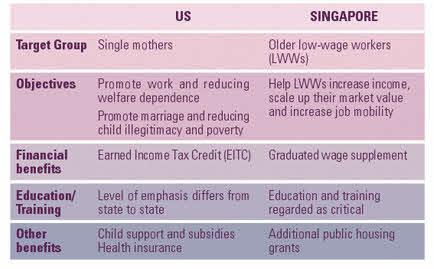

Enacted in 1996, welfare reform in the US involved far-reaching amendments to public assistance. Encompassing a broad set of policy changes, welfare reforms include welfare-to-work efforts, state waivers to achieve state-driven programmes, the Earned Income Tax Credit (EITC)1 expansions in Medicaid, as well as expansions in childcare subsidies and child support requirements.2 Welfare reform in the US is expressed in numerous models, with each state evolving its own system of welfare provision based on the general stipulations outlined in the Bill.

It was the system developed by the state of Wisconsin that served as a model for Singapore because of its numerous successes. First, a dramatic drop in the number of recipients on welfare was recorded in Wisconsin. This was made possible by the new requirement that made aid conditional on work. Substantial numbers of welfare recipients left the welfare rolls and took on jobs. Those that remained on welfare were required to fulfil work obligations designed to mimic the demands of regular jobs. Many of these jobs were generated by the state government3 and while they cost the state government more, it was considered necessary to induct long-term welfare recipients, many of whom lack working experience, into work. Second, former welfare recipients, if they had worked, were found to have earned an average annual income of US$5,0004 more than what they would have received if they had relied on welfare benefits.5 Third, it was found that a boost in the incomes of former welfare recipients had a positive effect on self-esteem.

While conditioning aid on work is a shared feature of both the Singapore and Wisconsin models, the underlying rationale for Workfare in the two places differs markedly. Workfare in Singapore was introduced with the primary purpose of helping low-wage workers increase their incomes. The plan has a stronger emphasis on increasing the financial capacity of low-wage workers through employment rather than to divert individuals away from welfare.

Welfare reform legislation of the US was aimed primarily at promoting work, which also reduced welfare dependence. To this end, workfare policies in the US were aimed at enabling the unemployed to take on wage employment. Stiff work requirements were imposed on those who remained in welfare. While in New York and Wisconsin, state governments took on the task of creating community jobs so that welfare recipients could fulfil work conditions to qualify for aid, in most states welfare recipients relied on jobs created by the private sector.

In contrast, Singapore does not have an extensive welfare system to begin with. Reducing welfare dependency is therefore not the main objective of Singapore’s workfare, although the spectre of rising welfare costs and a weakening work ethic are seen as unintended consequences that could materialise if the Government allowed welfare programmes to expand over time. The dilemma that the Government grappled with in devising a sustainable workfare programme was how to provide aid without undermining work incentives.

A second point of departure is that welfare reform in the US was also aimed at strengthening marriage, and reducing child illegitimacy and child poverty.6 There was growing evidence pointing to the fact that children raised by single mothers sustaining themselves on welfare were more likely to be trapped in a culture of poverty. This meant that children developed behavioural problems and low performance levels at school.7 The promotion of marriage was seen as the solution since it would give the child a stable home. Welfare in the US gave little incentive for the majority of recipients, consisting mostly of single mothers, to get married since being a single mother was one of the eligibility criterion used for determining welfare status. The aim that welfare reform would promote marriage however was mostly rhetoric, as in practical terms welfare reform focused mainly on raising work levels. States were explicitly mandated to put in place measures to encourage work; in contrast, there was little pressure put on states to create initiatives to promote marriage. Hence, it remains to be seen whether welfare reforms in the US will solidify marriages and promote more stable families in the long term.

SINGAPORE'S WORKFARE

The permanent implementation of Workfare in Singapore came a year after the Workfare Bonus Scheme (WBS) was introduced in 2006 as a one-off measure to boost the incomes of low-wage workers. The Workfare Income Supplement (WIS) announced in the 2007 Budget is a long-term programme targeted at older low-wage workers. Owing to the competition low-wage workers face from foreign workers who are willing to accept lower salaries, Singapore’s low-wage workers are encouraged not only to continue working under Workfare but also to seek relevant training to boost their prospects of securing better employment.

WORKFARE: KEY DIFFERENCES BETWEEN THE US AND SINGAPORE

In Singapore, the Government felt that the group in most serious need of help is older workers. Those who struggled to find work usually lacked relevant working skills. Thus, the target recipients of Workfare would be individuals who are already working or have worked for a defined period of time in the past year.

Like many pioneering states in the US, Singapore is at an experimental stage with Workfare. While strict time limits have been enforced on welfare recipients to secure jobs in the current Wisconsin system, Singapore’s Workfare initiative is not characterised by similar constraints. Since the aim in Singapore is to support and encourage work rather than divert individuals off welfare, it may be the case that WIS would be granted indefinitely to encourage recipients to keep on working. Taking this step may prove to be fortuitous since after all families may not necessarily achieve full financial independence within a fixed span of time, as was found in the US.8 Helping low-wage workers achieve greater financial independence may thus require sustained government intervention over a longer period of time.

The permanent implementation of Workfare in Singapore came a year after the Workfare Bonus Scheme (WBS) was introduced in 2006 as a one-off measure to boost the incomes of low-wage workers.

The Workfare Income Supplement (WIS) announced in the 2007 Budget is a long-term programme targeted at older low-wage workers. Owing to the competition low-wage workers face from foreign workers who are willing to accept lower salaries, Singapore’s low-wage workers are encouraged not only to continue working under Workfare but also to seek relevant training to boost their prospects of securing better employment.

RELATED INITIATIVES

That Workfare is supplemented by a cluster of related initiatives is a feature found both in Singapore and the US. One such initiative is education and training, which in Singapore is regarded as critical. The rationale is unambiguous: education and training are viewed as essential to expanding the skills of low-wage workers so as to boost their labour market value and increase job mobility, thereby enabling individuals to secure higher-paid jobs.

In contrast, Wisconsin eschewed training and emphasised work instead,9 since it was found that work experience proved to be far more valuable than the additional retooling individuals would receive had they chosen instead to receive training first. Furthermore, programmes that focused on work over training were regarded to be a more efficient use of resources.

Emphasising work over welfare has numerous benefits aside from the financial advantages it accrues.

By no means does this suggest that education and training are not features in the US welfare reform model. Some states in the US, such as Washington and New Jersey, have also set aside more generous budgets for education and training.10 Education and training by themselves, however, were not shown to reduce welfare dependence. These tools had to be complemented by child support and subsidies, the EITC, and health insurance in order to make a positive impact on the lives of welfare recipients.11 Childcare subsidies in particular were received favourably as it enabled single mothers to go out to work.

The additional staples involved in Singapore’s Workfare programme are uniquely Singaporean. Features such as additional public housing grants and special transfers of fiscal surpluses are substantially different from the US model. The rationale is to facilitate asset accumulation and to bring about some degree of income redistribution.

FINE-TUNING WORKFARE FOR SINGAPORE

Emphasising work over welfare has numerous benefits aside from the financial advantages it accrues: working engenders social inclusion; it raises the self-esteem of individuals; and it facilitates social mobility within and across generations. As in all policies and programmes, borrowing models from others should be done selectively because of different historical, cultural and social, and demographic orientations.

The design of Workfare would have to take into account local requirements and constraints. Currently, Singapore’s Workfare model only admits individuals who work in the formal sector and, as a consequence, only those who contribute to the Central Provident Fund (CPF). As such, workers engaged in the informal sector may not be able to tap into the benefits of the Workfare programme. In this case, there may be a need to devise other methods of tracking an individual’s work history other than using the CPF system. That low-wage workers do not have to contribute to CPF also makes this an ineffective tracking method, although there are efforts to try to bring every low-wage worker under the CPF net.

Another area where Workfare policymakers in Singapore are likely to have to grapple with is whether women should be given more attention, since they are more likely than men to face difficulties in achieving financial self-sufficiency. The predicament in which they often find themselves is a consequence of structural, social and cultural factors. As in many parts of the world, Singaporean women generally earn less and, more often than men, find themselves in lower-paying jobs. Even if they have worked, many spend fewer years of their lives in paid employment compared with men, as they are obliged to enter and exit the labour force to provide care for their children and aged parents in keeping with social and cultural demands that posit that they are primary caretakers of their families.12 These factors suggest that women end up with less savings than men to sustain themselves in old age. Furthermore, that married women outlive their husbands means that greater numbers would find themselves in dire straits especially if they were low-wage workers during their work life. Finally, the fact that women continue to undertake roles as primary caregivers in the family suggests that some of the assistance offered under Workfare should be extended to caregivers.13 Hence, the design of Workfare may also need to take into account the demographic particularities of Singapore rather than subsuming all low-wage workers in a single, undifferentiated category.

Workfare may need to take into account the demographic particularities of Singapore.

State governments across the US have been experimenting with welfare reform for years or even decades before the Welfare Reform Bill was announced. Invariably, Workfare in Singapore should take into account developments in the US in so far as it wants to discover what works and what does not when helping low-wage workers. More importantly, Workfare in Singapore should evolve and adapt to its own demographic and economic circumstances. Already, the Prime Minister has announced that WIS would be increased by up to two times for eligible older workers aged above 55. These adaptations will require a good measure of discernment on the part of Singapore’s Workfare policymakers. While it may be useful up to a point to import ideas from other countries, what is most critical in directing the future development of Workfare is to understand the profile and culture of Singaporean low-wage workers and how they respond to the current Workfare programme.

NOTES

- The Earned Income Tax Credit (EITC), otherwise called the Earned Income Credit (EIC), is a refundable federal income tax credit for low-income workers and families. The underlying rationale of the EITC is that a tax refund may be claimed if it exceeds the amount of taxes owed.

- Blank, Rebecca, “What We Know, What We Don’t Know, and What We Need to Know about Welfare Reform” (paper presented at the “Ten Years After: Evaluating the Long-Term Effects of Welfare Reform on Children, Families, Work and Welfare Conference” organised by the University of Kentucky Center for Poverty Research, Kentucky, USA, 12-13 April, 2007).

- Mead, Lawrence M., personal communication, 21 June 2007.

- Rebecca Blank has cautioned not to homogenise the welfare recipient group as there are single women who have been found to be worse off after welfare reform particularly in finding and retaining jobs (see Note 2).

- Evidently, the welfare system prior to 1996 indirectly encouraged the perpetuation of single-parent households for which the US federal government saw urgency to correct.

- Duncan, Greg J. and Brooks-Gunn, Jeanne, Consequences of Growing Up Poor (New York: Russell Sage Foundation, 1997).

- Under welfare reform 1996, it was found that few families in reality achieved full financial independence and, as such, most were not able to move away from assistance completely. See Cancian, Mary and Meyer, Daniel R., “Alternative Measures of Economic Success among TANF Participants: Avoiding Poverty, Hardship, and Dependence on Public Assistance,” Journal of Policy Analysis and Management 23 (2004): 531-48.

- While the state of California generally mandated education and training in its welfare reform, the county of Riverside was an exception as it emphasised work over education and training. Like Wisconsin, Riverside was characterised by high job placement rates and low rates of engagement in education and training which accounted for its success. Note also that Riverside did not provide financial benefits nor did it impose time limits. See Walker, Robert, et al., “Successful welfare-to-work programs: Were Riverside and Portland really that good?” Focus 22 (2003): 11-18.

- Cancian, Maria, et al., “Income and program participation among early TANF recipients: The evidence from New Jersey, Washington, and Wisconsin,” Focus 22 (2003): 2-10.

- Devasahayam, Theresa D. and Yeoh, Brenda S. A., Working and Mothering in Asia: Images, Ideologies and Identities (Singapore and Denmark: National University of Singapore Press and Nordic Institute of Asian Studies, 2007).

- There is evidence demonstrating that poor women in Singapore struggle to negotiate adequate childcare provision, being forced instead to remain in the home or at best seek the services of Family Service Centre. See Davidson, Gillian M., “The Spaces of Coping: Women and ‘Poverty’ in Singapore,” Singapore Journal of Tropical Geography, 17 (1997): 113-31.